how to answer are you exempt from federal withholding

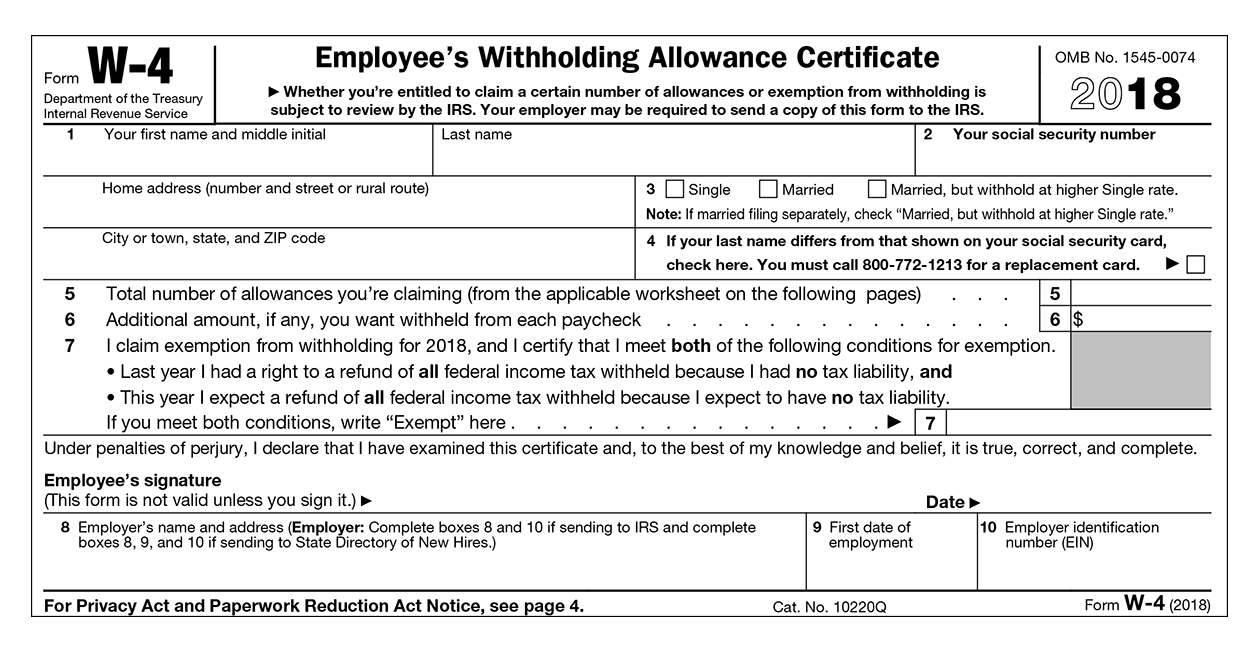

Your company will deduct. To claim exempt from federal withholding you need to fill out a W-4 Form and write the word EXEMPT on line 7.

How To Fill Out A W4 2022 W4 Guide Gusto

Until the employee furnishes a new Form W-4 the employer must withhold from the employee as from a single person.

. Should a high school student claim exempt on w4. If an employee wants to claim exemption they must write Exempt on Form. If you start a new job and fill out a Form W-4 claiming exemption your employer is required to withhold nothing from your paycheck for federal taxes.

Exempt means they wont have any Federal or State Withholding. If however a prior Form W-4 is in effect for the employee. You can claim up to three allowances on the W-4 form.

You can tell your boss how much money to withhold by filling out a W-4 form. If youre a US. The reporting of tax-free items may be on a taxpayers.

If you can be claimed as a dependent on someone elses tax return you will need an estimate of your wages for this year and the. This is great if you owe no. An estimate of your income for the current year.

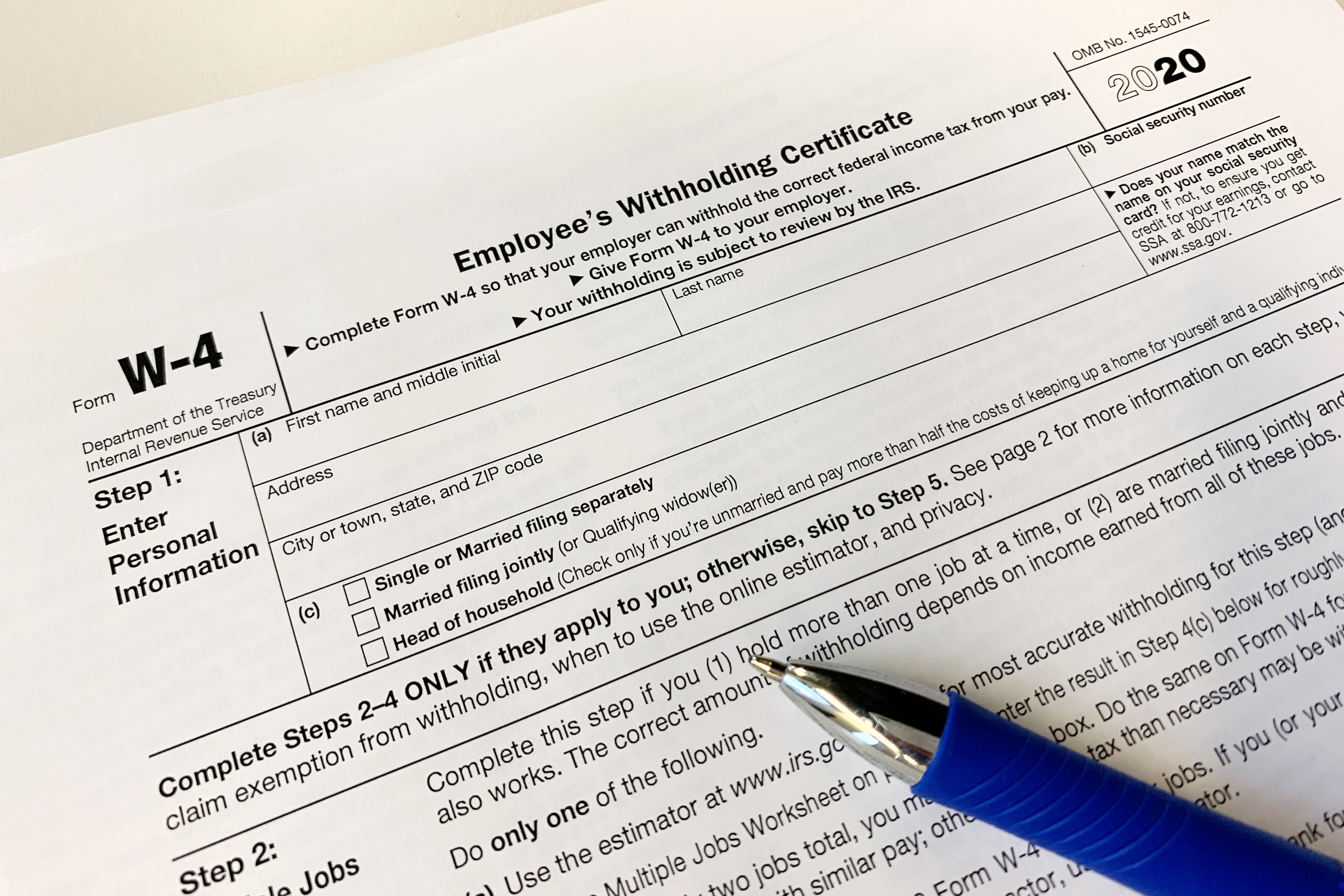

This form is completed by the employer and instructs them on how much to deduct from each paycheck. Do not complete lines 5 and 6 and write Exempt in the box on line 7. Write Exempt in the space below Step 4c Complete Steps 1a 1b.

Perfect answer When you file as exempt from withholding with your employer for federal tax. Your status as a full-time student doesnt exempt you from federal income taxes. If you want to claim complete exemption from withholding you still need to file a W-4.

What Does Are You Claiming Full Exemption From Federal Tax Withholding Mean. Defining Tax Exempt Tax-exempt refers to income or transactions that are free from tax at the federal state or local level. On your W-4 enter your identifying information such as your name address and Social Security number.

A new W-4 form is now in effect for all new hires and employees who want to change their W-4 forms. Your employees can claim exempt on their Federal Form W-4 or state form if they meet certain requirements.

Solved What Is The Purpose Of Extra Withholding Under The State Section Of The Employee Taxes

State W 4 Form Detailed Withholding Forms By State Chart

What Are Tax Exemptions Turbotax Tax Tips Videos

Can I File Exempt On The Irs Form W4 Tax Withholding Exempt Qualifications Youtube

Ch 4 Ba218 Personal Finance Flashcards Quizlet

What Are Tax Exempt Organizations Asu Lodestar Center For Philanthropy And Nonprofit Innovation

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service

How To Fill Out The W 4 Form New For 2020 Smartasset

Federal Tax Withholding In 2021 Youtube

Exempt From Backup Withholding What Is Backup Withholding Tax Community Tax

Doing Business In The United States Federal Tax Issues Pwc

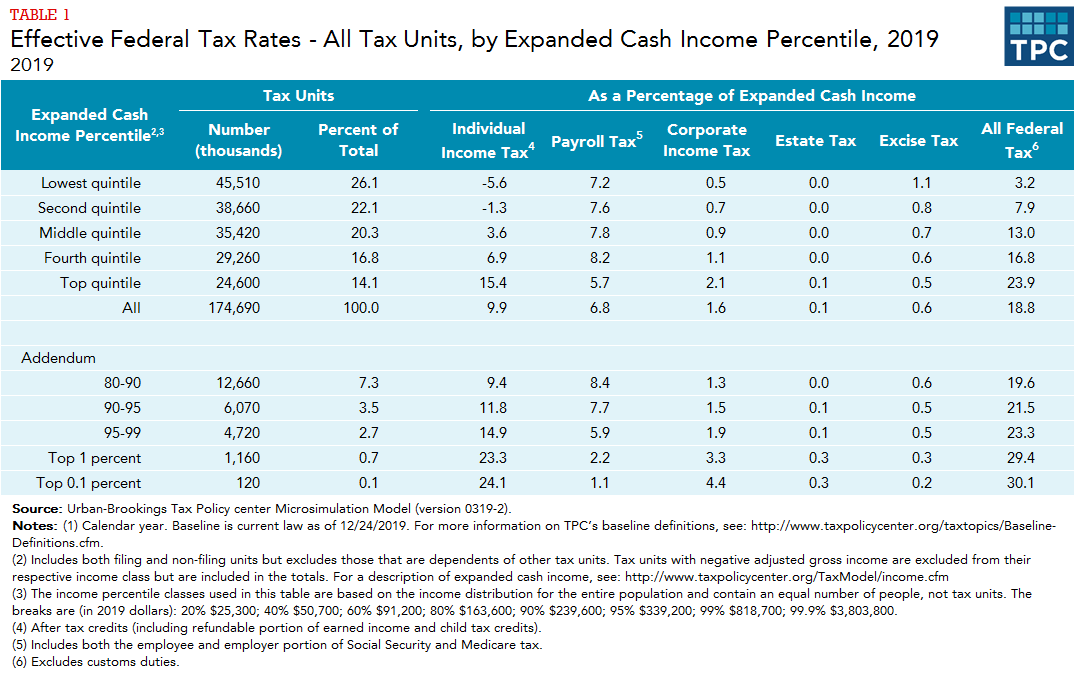

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

How To Fill Out A W4 2022 W4 Guide Gusto

Understanding Your W 4 Mission Money

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Irs Has A New Easier W 4 For Withholding Taxes In 2020 Money

Uploading Your Tax Exemption Certificate On Shop Wagnercompanies Com Knowledgebase Faq Help Center The Wagner Companies

State Individual Income Tax Rates And Brackets Tax Foundation

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero