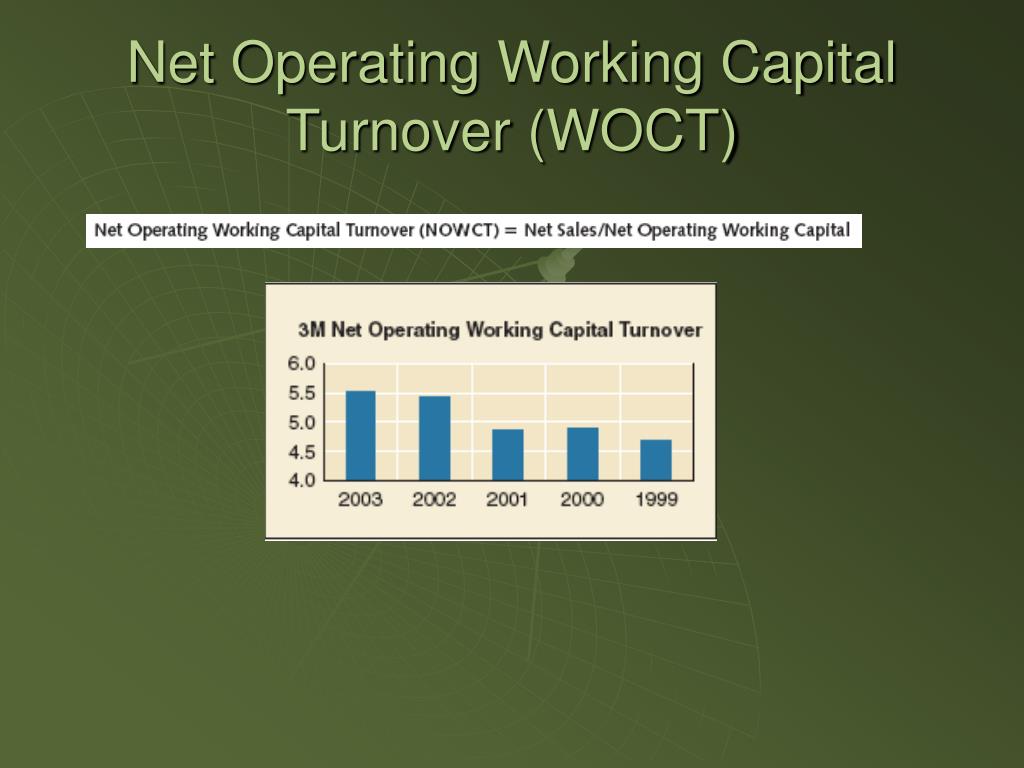

net operating working capital turnover

In this formula the working capital is calculated by subtracting a companys current liabilities from its current. Since net sales cannot be negative the turnover ratio can.

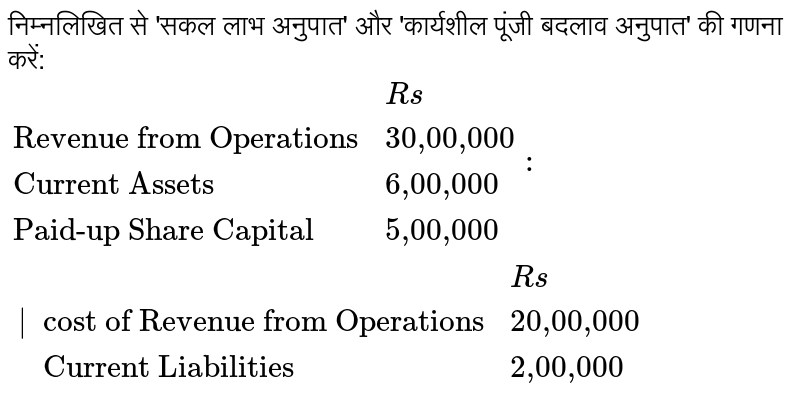

From The Following Calculate The Gross Profit Ratio And Working Capital Turnover Ratio Rs Revenue From Operations 30 00 000 Current Assets 6 00 000 Paid Up Share Capital 5 00 000 Rs Cost Of Revenue From Operations

Working capital turnover Net annual sales Working capital.

. Current Operating Assets 100000 Cash 75000 AR. WCT NAS AWC WCT Working Capital Turnover NAS Net Annual Sales AWC Average Working Capital The Net. The amount of a companys working capital changes over time as a result of different operational situations.

The working capital turnover ratio formula is calculated by dividing the companys net annual sales by its average working capital naturally if your working capital turns negative. Working capital turnover ratio is computed by dividing the net sales by average working capital. Net annual sales divided by the average amount of working capital during the same year.

The working capital turnover equation is as follows. The working capital turnover is a ratio to quantify the proportion of net sales to working capital. Net Operating Working Capital Turnover.

It shows companys efficiency in generating sales revenue using total working. The Working Capital Turnover Ratio is calculated by dividing the companys net annual sales by its average working capital. Working capital turnover is a ratio that measures how efficiently a company is usinWorking capital turnover measures how effective a business is at generating saA higher working capital turnover ratio is better and indicates that a company is ablHowever if working capital turnover rises too high it could suggest that.

Thus working capital can serve as an indicator of how a. NWC Total current assets total current liabilities Your total current assets are your cash assets plus accounts receivable. The working capital turnover is calculated by taking a companys net sales and dividing them by its working capital.

The calculation of its working capital. Example of Working Capital. With this information you can calculate NOWC by doing the following net operating capital calculation.

Net operating working capital is equal tooperating current assets less operating current liabilities. ABC Company has 12000000 of net sales over the past twelve months and average working capital during that period of 2000000. The working capital turnover ratio is calculated as follows.

Working Capital is calculated by subtracting total liabilities for. Net Working Capital NWC 60000 80000 40000 5000 NWC 95000 Since we now have the two necessary inputs to calculate the turnover ratio the remaining step is to. Formula to Calculate Working Capital Turnover Ratio Net Sales Sales Returns Working.

It measures how efficiently a business turns its working capital into increase sales. Net operating working capitalis an asset that. Operating Current Assets 25 million 40 million 5 million 70 million Operating Current Liabilities 15 million 10 million 5 million 30 million Upon netting those two values.

To calculate net working capital use this formula. Working capital is calculated by subtracting current liabilities from current assets.

Revenue From Operations Cash Sales Q 107 Ch 4 Accounting Ratios

Operating Working Capital Owc Financial Edge

Working Capital Turnover Ratio Meaning Formula And Example

Financial Ratio Analysis Working Capital Turnover Ratio Mudranka

From The Following Calculate The Gross Profit Ratio And Working Capital Turnover Ratio Rs Revenue From Operations 30 00 000 Current Assets 6 00 000 Paid Up Share Capital 5 00 000 Rs Cost Of Revenue From Operations

Ppt Financial Analysis Powerpoint Presentation Free Download Id 638693

What Is The Working Capital Turnover Ratio And How Is It Calculated

Asset Turnover Formula And Calculator Step By Step

Prepare A Common Size Balance Sheet Of Kj Ltd From The Following Information Particularsnote No 31 3 2017 Rs 31 3 2016 Rs I Equity And Liabilities 1 Shareholder S Funds 8 00 000 4 00 000 2 Non Current Liabilites 5 00 000

Dr Marie Bani Khalid Dr Mari E Banikhaled Ppt Download

Calculate Revenue From Operations Of Bn Ltd From The Following Information Current Assets Rs 8 00 000 Quick Ratio Is 1 5 1 Current Ratio Is 2 1 Inventory Turnover Ratio Is

Operating Working Capital Turnover Ppt Powerpoint Presentation Gallery Background Designs Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Asset Turnover Ratio Double Entry Bookkeeping

Working Capital Formula How To Calculate Working Capital

Question 138 Chapter 4 Of 2 B T S Grewal 12 Class Tutor S Tips

Working Capital Turnover Ratio Formula Calculator Excel Template